5 product management KPIs that tell you more than NPS

.png)

.png)

Reviewing the results of customer surveys can be thrilling. Finding the customers who’ve latched on to your product and become your brand's cheerleaders affirms the value of your hard work.

Many businesses use survey results to calculate their Net Promoter Score, so they have a good handle on the overall sentiment of their customers. But how can you dive into that number even more and back up your results with data-based product management KPIs?

After all, your survey results aren’t always reliable. You’re counting on customers to respond to your survey, and you expect that their responses will reflect their behavior with or attitude toward your product. You may have a customer who raves about your product but uses few of its key features.

NPS is important, but you can gain an even more nuanced understanding of your customers by also reviewing other KPIs. You can compare what your customers are reporting to you to the data that you have gathered on your own. By looking for discrepancies, you can better predict customer retention and potential churn.

The key is not only to identify the right product management KPIs to use, but also to understand what the data is telling you.

The number of active users is a strong indicator of your product's overall adoption. Active users are the ones relying on your product as an integral part of their needs, with whatever you are delivering.

But first you have to decide what makes a user “active” based on your business model.

The definition of "active" will vary. For example, if you provide a project management tool, you may expect users to be working within the tool several times per week. If you have a platform that supports sales tax reporting, you may only expect your users to log in a few days per month.

From there, you can select the right time frame for measuring daily active users (DAU), weekly active users (WAU), or monthly active users (MAU). If you expect your users to be active within your product every day, your product management KPI may look something like this:

As you review your metrics around active users, you should ask yourself the following questions:

If your metric is falling short, that’s an indicator that your users are not seeing the full value of your product or are perhaps relying on outside tools to meet their needs. You may see that only 50% of your users are DAU, and you have set a benchmark of 65% for DAU. The next question: Why? Do they not understand the functionality available, or does the product itself not fully meet their needs, so they are continuing to use other products as a supplement?

By collecting feedback or reviewing the amount of time spent in different parts of your product, you can glean insights into how users are behaving, what they are expecting, and how you can improve your overall rate of active users.

While the number of active users tells you if your users are accessing your product, you should take it a step further and identify how much time they are spending in your application. Users who spend more time in your application understand its benefits. Users who log in and log out quickly don’t fully understand the product functionality or have written off your product as “lacking enough value.”

Products like Amplitude can help you identify user behavior. With starting and ending points, you can to uncover how users are spending time within your app and whether they are leaving when they reach a certain point. If you put this intelligence to use, it will help you identify what areas of the app are underutilized or where the product experience is not leading your users through the expected user journey.

You'll need to establish a benchmark to determine a healthy amount of time spent in-app and the number of features touched or the path(s) the user should take. This should be guided by your power users: those who have a deep understanding of product usage and take it to the next level by promoting your product's awesomeness. A combination of metrics on product usage and NPS or survey results should help you define this further.

If you have users who fall below the product management KPIs that you have established around time—identify why, and then brainstorm ways to reach these users. It could be that certain features are being underutilized, the UX is unclear, or product features are not apparent. Not all users are curious enough to poke around in apps and figure out everything a product can do for them. You may also discover that that all your fancy new features have gone unnoticed and untouched by the majority of your user base.

Moral of the story? You need to implement ways to stay in front of your users and guide them through everything that your product offers and the value you provide.

While you are aware of what sets your product apart from your competitors, the reality is that users have a lot of options. You risk losing customers if it takes too long for them to recognize the distinct value that your product offers.

Your customers need to reach the tipping point, where they fully embrace your product and consistently use it—whether that’s daily, weekly, or monthly. From there, you can continue to improve the user experience for them, which will lead to higher customer retention.

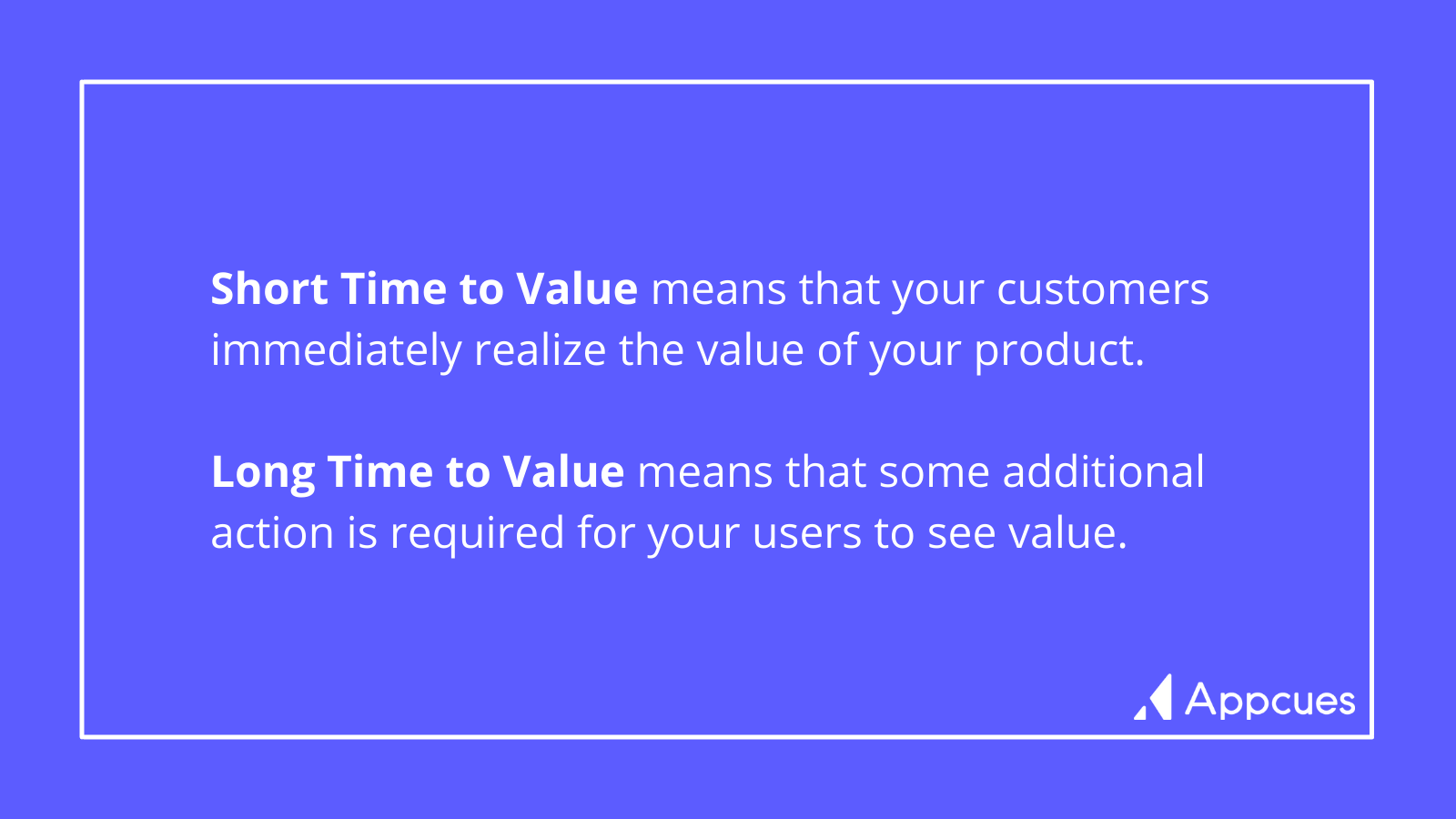

Establish product management KPI around "time to value": How long does it take your customers to reach their aha moment or their activation event and realize your product's value? Time to value can be broken down further.

With short time to value, your users log-in, look at your app’s features, and “get it.” A product with a longer time to value may require collaboration with teammates, importing data, or integrating with other tools.

Examining user behavior will help you measure time to value. You'll need to drill down into the customer journey, which may either have a straightforward path to an aha moment or take several nonlinear steps. That tipping point happens when your users find more and more features to love.

Is that time until they hit those aha moments reflected in days, weeks, or months? Once you've noted a baseline, your product management KPIs can work on reducing that amount of time. The lower your time to value, the better—you want to give users as little time as possible to consider your competitors. Optimize your onboarding experience with personalized flows that guide users toward the aha moment and reduce that time to value.

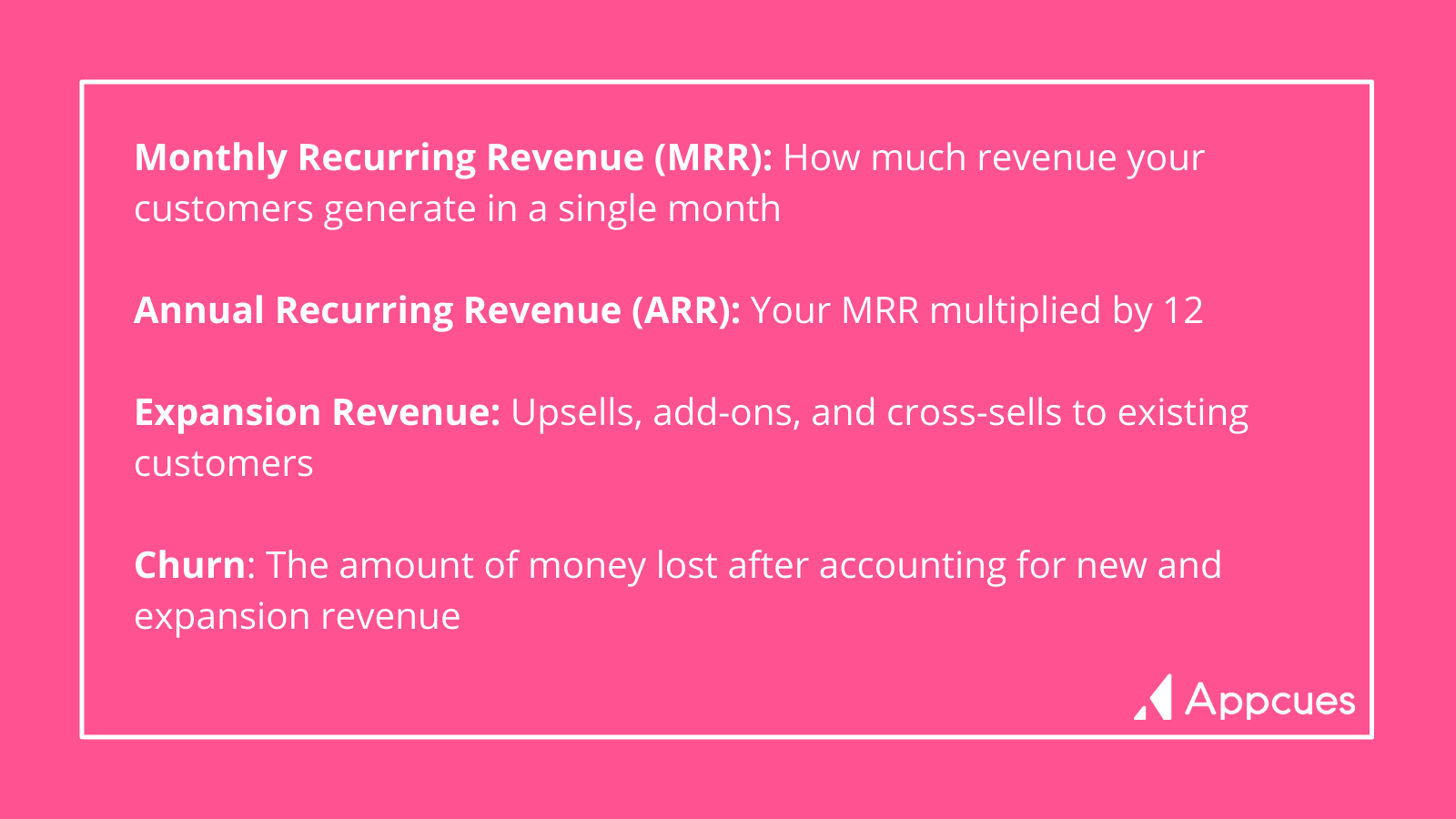

It doesn’t matter how many new users you bring in—if they don't see your product's value, they'll probably churn quickly. Revenue metrics reflect your customers’ satisfaction with your product:

If MRR or ARR stagnates, this can tell you several things as a product manager. It may indicate slow growth in new customers or large losses in existing customers. To experience growth, your additional MRR, ARR, and expansion revenue need to outpace any revenue lost through churn.

For example, if you offer a free trial of your product, how many of those prospects turn into recurring, paying customers, increasing your overall MRR or ARR? If they do not convert, can you identify product shortcomings or other reasons for the loss of potential revenue? (Hint: This is where the time in-app and time to value come into play.)

Expansion revenue indicates high customer satisfaction because your customers see so much value that they are willing to invest more. If you don’t see increasing expansion revenue, it can mean that your customers aren’t happy enough with your product or that you aren’t doing enough to promote upsell or cross-sell opportunities.

According to ProfitWell, 30% of your revenue should be expansion revenue, and most companies see far less than that. Expansion revenue requires you to tackle the issues of both getting your customer to recognize value of the investment they have already made and making them aware of the expansion opportunities.

While you don’t want to make product decisions solely based on sales, you should focus on gaining and maintaining that revenue over time as a product manager. You can break down your product management KPIs by revenue type (recurring, expansion, churned) and customer (new or existing) to see trends over time and find areas of improvement.

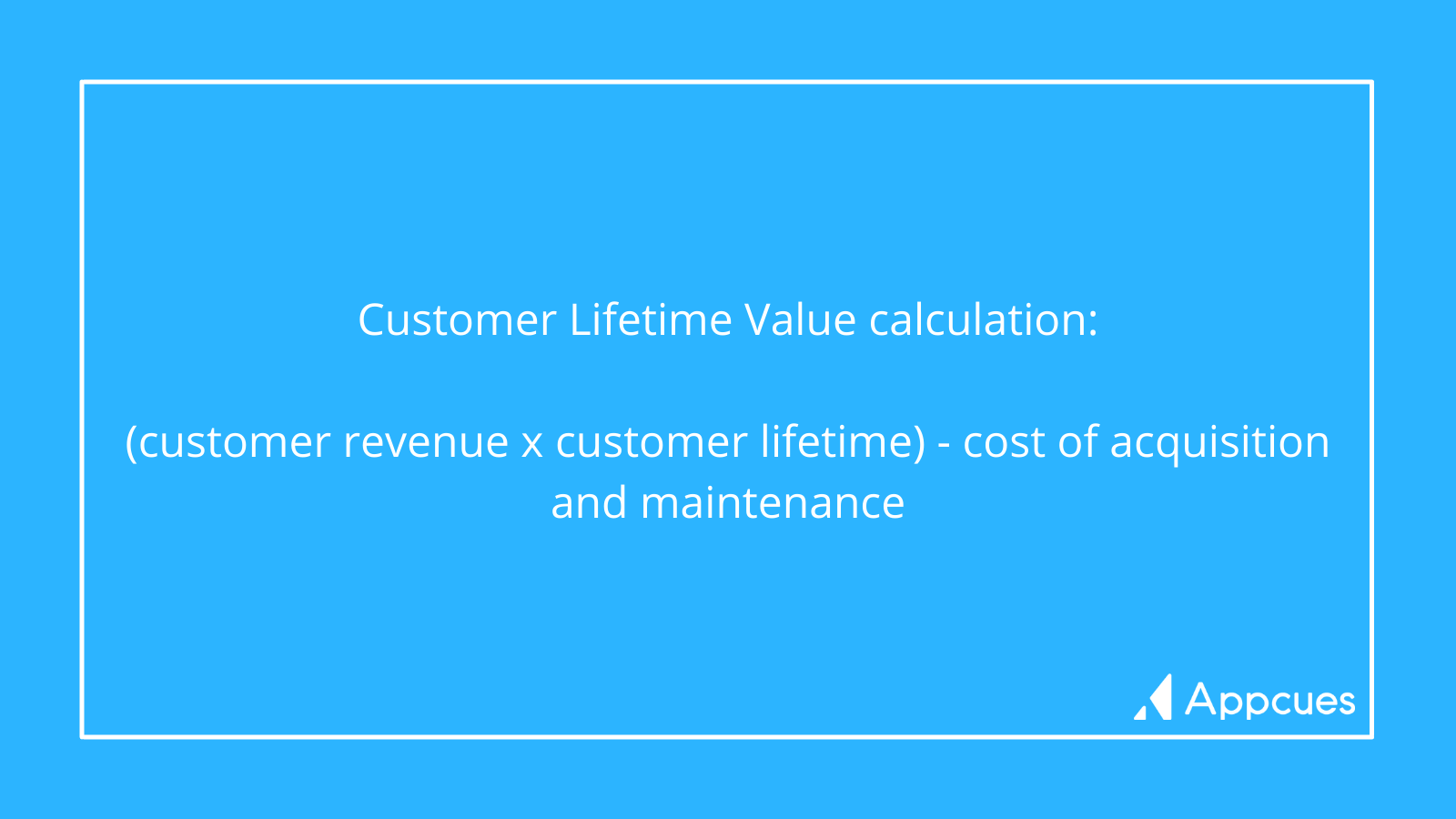

While you may have overall positive customer sentiment in your NPS, the true test of that customer's worth is your customer lifetime value or CLV:

In many SaaS models, particularly those with a long time to value, the costs to acquire a customer are high. Between sales and marketing efforts, plus any costs with initial onboarding, it could take months or years to recoup the cost.

Your customers may give enthusiastic feedback in a survey and may have turned into "promoters" of your product, driving new business. However, particularly in B2B environments, promoters aren’t always the decision-makers and don’t reflect overall sentiment or the potential length of the relationship. If customer acquisition and maintenance costs are high, promoters who fall into this category may not provide as much value as you think.

A high CLV customer brings in enough recurring revenue to offset the associated costs, continues to invest in the product over time with upsells and cross-sells, and maintains a long business relationship. If you end up "upside down" on your CLV, you cannot grow your business in the long run. As a product manager, your focus should be on how to increase overall customer retention and how to reduce overall maintenance (support) costs through product stability and ease of use.

While NPS gives you an idea of overall customer sentiment, product management KPIs help you gauge how your product is delivering value on a more granular level. Combined, NPS scores and customer data tell a story about how users are interacting with your product.

It’s your job as a product manager to interpret product management KPIs and pull insights from them. When the numbers fall below expectations, identify shortcomings you can improve—whether that’s helping more users reach their aha moments or boosting awareness of existing features.